Anyone capture headlines approximately the current Netflix profits call? Pretty tame this time around, proper…? I DON’T THINK SO! Unless you’ve been dwelling below a expert rock (or taken a vacation together along with your paintings e-mail sincerely became off, wherein case pass you, set the ones boundaries!) you may, may, may have study approximately Netflix’s Terrible, Horrible, No Good, Very Bad Day.

SUBSCRIBER LOSS!!!… for the primary time in a decade. Driven with the aid of using the pullout from Russia, aleven though, greater significantly, additionally pushed with the aid of using authentic softening withinside the U.S. (in which they delivered a fee hike).

CRACKDOWN ON ACCOUNT SHARING!!!… with the provider estimating as many as a hundred million families the usage of through password sharing. That’s greater than 30% in their userbase.

ADVERTISING!!!… No, now no longer as preferred for your contemporary subscription plan, regardless of what a few information retailers might suggest. A separate tier coming sooner or later withinside the future.

Takes are going like hotcakes. Horror leads the headlines as all of us watch Netflix’s inventory fee implode. Call me naïve, however I’ve by no means understood why it’s so outrageous to look some thing that went up, come down. Matthew Belloni at Puck News issued a groovy dissection of the connection among Netflix, Hollywood, and Wall Street, which I located to be a clean counter to the generalized hysteria.

Trouble at Netflix Family Animation

Amongst the chaos, TheWrap dropped a blistering dispatch approximately Netflix Animation, which I might spotlight as THE study proper now for all of us running withinside the youngsters and own circle of relatives content material space. After the honeymoon period, which noticed Netflix cherry-choose creators from essential studios, the enjoy for lots appears to have soured. Problems reportedly encompass combined messages, set of rules impotence, fudgy data, hand-shackled marketing, and distribution incarceration.

A “thesis” evolution from:

“We need to be the house of everybody’s favourite display”

to

“We need to make what our target target market desires to see”

speaks to the vast shift in commissioning strategy. This leaves Netflix with a piece of an identification crisis, especially on account that there has been a clean attention on greenlighting modern-day collection in the medium of animation, and the style of youngsters, for years. Shows like City of Ghosts and Centaurworld have been constantly going to take nurturing to locate an target target market, irrespective of the network.

This comes a month after a completely candid interview with Rachel Shukert, collection writer of Netflix Original The Baby-Sitters Club, which protected comparable ground. The “binge-cappotential index,” which appears to be a center Netflix priority, will constantly play in another way for youngsters collection. Success right here in all likelihood seems greater like sitcom consumption—consolation viewing in which the in keeping with episode repeat thing is out of this world.

Unfortunately, with the aid of using nature, publicly launched Netflix metrics will conflict to surely inform this story. The company’s Global Top 10 lists are a masterclass in obfuscation. A bamboozle of data, with simply sufficient granularity to save you any type of complete view of the picture. Nevertheless, we (I!) persevere in portray a few context on a complex canvas.

Netflix Kids Series Performance in Q1 2022

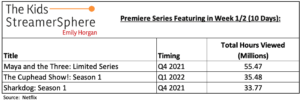

Sticking with collection, content material overall performance for Q1 noticed engagement with exactly the form of display Netflix has been regarded for. The Cuphead Show! follows quirky characters, in a antique animation style, and is the primary youngsters collection to hit 3 weeks of the Global Top 10s with 47.29m hours considered.

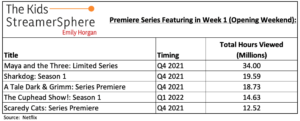

Although we don’t have comparisons for this throughout 3 weeks, under is the way it stacks up in opposition to different youngsters indicates throughout Week 1 and Week 1/2, aleven though it become the handiest youngsters collection to characteristic this quarter.

What’s very clean is that Maya and the Three stays the standout instance of intersection among high-quality animation and huge appeal. Series writer Jorge R. Gutierrez took to Twitter to verify that he’s very plenty open for commercial enterprise at Netflix, regardless of the onslaught of headlines.

Netflix Kids Movie Performance in Q1 2022

In movies, the live-motion sequel Tall Girl 2 featured throughout 3 weeks, coming in moderately robust with greater than 27m hours considered in its commencing weekend. This beats The Princess Switch 3, which drove a seasonal 25m hours withinside the lead-as much as Christmas.

Another exciting component we will see is licenses, possibly re-activating, throughout more than one movies from NBCUniversal’s Illumination/DreamWorks franchises. Originals and sequels from Despicable Me and Shrek experience multi-week featuring. These movies are in all likelihood of their seventh/eighth/9th distribution home windows relying at the market. They stay cherished with the aid of using youngsters, and an crucial a part of ongoing viewer achievement for streamers, as mentioned withinside the preceding installment of this newsletter. It’s comprehensible that they don’t hit pretty as warm as advertised Netflix Original premieres Vivo and Back to the Outback. Their cappotential to chart at the Global Top 10 in any respect manner that those antique workhorses are beating out masses of opposition throughout all genres.

What does Netflix do next?

So, what does Netflix do now? It’s a query the whole enterprise is gagging to answer. The company’s dating with NBCUniversal may also have wobbled in current years, however it appears to have stabilized on the proper time. Licensing offers on franchise movies are absolutely flowing thru the provider. The collection pipeline is likewise robust for each new, authentic ideas and derivatives. The Boss Baby: Back withinside the Crib, Kung Fu Panda: The Dragon Knight, and Gabby’s Dollhouse S5 are all ones to watch.

I wager the trouble is, past DreamWorks, how many “true” in-residence originals can surely supply ongoing target target market engagement this is the important thing cost for the youngsters target target market? Is that what they’re even going for? Or is it binge-cappotential to rule them all? Here’s hoping now no longer. If there may be one component we understand over right here in our little nook of youngsters media, going four quadrants ≠ making use of the identical technique 4 times.